Staying Legal While Working Online in the Philippines

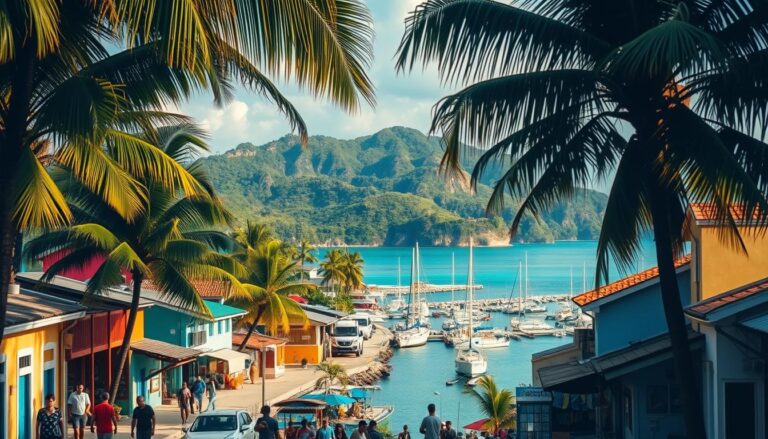

Dreaming of trading your office for a beach? Many location-independent professionals are drawn to the beautiful islands of this Southeast Asian country. However, it’s crucial to understand the rules for remote professionals.

In May 2023, the government made a major announcement. They plan to launch a special program for global professionals. This new visa offers a formal path for foreign freelancers and remote employees.

This development is a game-changer. It allows you to live in a tropical paradise for up to a year, with renewal options. More importantly, it provides clear legal standing for your work.

This guide will walk you through everything you need to know. We’ll cover eligibility, the application process, tax details, and fantastic places to live. Our goal is to help you make a smooth and compliant transition.

Key Takeaways

- The Philippines announced a new visa specifically for location-independent professionals in 2023.

- This visa provides a legal way to live and work remotely in the country for up to two years.

- Working on a tourist visa is not permitted and carries risks like deportation.

- This guide covers eligibility, application steps, taxes, and cost of living.

- Proper authorization protects you and allows you to fully enjoy the experience.

Introduction to Legal Remote Work in the Philippines

As borders become more flexible for location-independent careers, the Philippines emerges as a premier destination. The COVID-19 pandemic accelerated global acceptance of remote arrangements. This shift prompted many nations to create specialized programs for skilled professionals.

The archipelago offers compelling advantages for remote workers. English is widely spoken as an official language. The culture is famously warm and welcoming across its 7,000 stunning islands. The cost of living remains significantly lower than in Western countries.

Before this new program, remote workers faced complex challenges. Many operated in legal gray areas using tourist visas. Traditional work visas required local employer sponsorship, which didn’t fit remote professionals’ needs.

The Digital Nomad Visa changes everything. It provides explicit authorization to work remotely for foreign employers. This eliminates previous risks and uncertainties. Professionals can now establish stable banking relationships and sign long-term leases with confidence.

Understanding the Philippines Digital Nomad Visa

Navigating visa requirements just got easier for international freelancers and remote employees. This specialized program is a formal permit for professionals who work for clients or companies based outside the country.

Overview and Benefits

The digital nomad visa provides clear legal standing. You gain the right to work remotely without worry. This is a major advantage over using a tourist visa.

Key perks include an exemption from local income tax on your foreign earnings. It also allows you to open a local bank account and sign a long-term lease. This creates a stable foundation for your life abroad.

This visa is a game-changer for remote professionals seeking legitimacy and peace of mind.

Visa Validity and Renewal Options

The initial nomad visa is valid for 12 months. This offers ample time to settle in and build a routine. After one year, you can apply for a renewal.

The renewal grants an additional 12 months of stay. This means you can enjoy up to two continuous years under this visa philippines program.

| Feature | Initial Visa | Renewed Visa |

|---|---|---|

| Validity Period | 12 Months | 12 Months |

| Maximum Stay | 1 Year | 2 Years Total |

| Income Source | Must be from outside the Philippines | |

This digital nomad visa is ideal for freelancers, remote employees, and online entrepreneurs. It is not for those seeking local employment. Your income must originate from foreign sources.

Staying Legal While Working Online in the Philippines: Key Considerations

Operating without the correct visa can turn a dream lifestyle into a stressful situation. Understanding the rules is your first step toward a smooth experience.

Many remote workers have historically operated in a gray area. They used tourist visas for work, assuming it was fine since their income was foreign. This is a risky misconception.

Immigration law in the Philippines, like most countries, technically prohibits any work on a tourist visa. This includes checking emails or joining video calls for a company based in another country. Enforcement is increasing globally.

Working illegally carries serious risks. These include deportation, fines, and future visa denials. You also lose access to legal protections and face challenges opening bank accounts.

When deciding on the digital nomad visa, consider these key points:

- Your intended length of stay: Is it a few months or over a year?

- Your need for stability: Do you require long-term lease options or a local bank account?

- Your peace of mind: The digital nomad program provides clear, legal authorization.

This specialized visa eliminates uncertainty. It allows you to focus on your work and enjoy the beautiful surroundings with full compliance.

Tourist Visa vs. Digital Nomad Visa: Legal Implications

Understanding the fundamental legal differences between a standard tourist visa and the new digital nomad visa is essential for compliance. The core distinction is simple yet critical.

Limitations of Tourist Visas

Most visitors enter visa-free for 30 days. US citizens get 59 days. These stays can be extended for up to six months.

However, all tourist visas strictly prohibit any work. This includes remote work for a foreign employer. You cannot legally open a bank account or sign a long-term lease on a tourist status.

Extended stays require costly fees and border runs. This can total $500-$800 per year. It also creates work disruption and legal uncertainty.

Legal Protections of the Digital Nomad Visa

The specialized nomad visa changes everything. It provides explicit authorization to work remotely for companies abroad. This protects you from deportation risks.

It grants stability with an initial 12-month validity, renewable for another 12 months. The estimated fee of $200-$500 is often more economical for long stays.

| Feature | Tourist Visa | Digital Nomad Visa |

|---|---|---|

| Work Permission | Strictly Prohibited | Explicitly Granted |

| Max Stable Stay | ~6 months (with extensions) | 2 years |

| Annual Cost Estimate | $500 – $800 | $200 – $500 |

This digital nomad visa offers peace of mind. It allows you to build a stable life with full legal standing.

Eligibility and Application Requirements

So, who exactly can qualify for this exciting opportunity? The criteria are designed to be clear and accessible for genuine remote professionals.

The program welcomes freelancers, remote employees, and online entrepreneurs. Your key qualification is a stable income sourced entirely from outside the country.

Minimum Income and Employment Proof

While official figures are pending, the anticipated income requirement is competitive. Expect to show proof of a monthly income between $2,000 and $3,000.

This aligns with similar programs in the region, like Malaysia’s. It is far more accessible than Thailand’s higher threshold.

What counts as valid proof? You can use employment contracts, client invoices, or bank statements. The goal is to demonstrate consistent earnings from foreign sources.

A clean criminal record is also mandatory. You will need a police clearance certificate, often with an Apostille for international use.

Necessary Documentation and Health Insurance

Comprehensive health insurance is non-negotiable. Your policy must cover the entire duration of your stay.

This protects you and the local healthcare system. Standard travel insurance may not be sufficient.

A major advantage is the lack of employer sponsorship. This makes the visa ideal for truly independent professionals.

While details are still emerging, it is expected that applicants can include family members. This would likely require additional documentation and a higher income threshold.

Understanding Tax Exemptions and Financial Benefits

One of the most compelling financial incentives for choosing this archipelago is its favorable tax policy for remote professionals. This program offers significant advantages that simplify your financial life abroad.

The primary benefit is the expected exemption from local income tax on all foreign-sourced earnings. This means your salary from a company based in another country remains untaxed locally.

Exemption on Foreign Income

Foreign-sourced income includes payments from clients or employers located entirely outside the host nation. This covers remote work for international firms and freelance projects for overseas clients.

This policy is more straightforward than programs in places like Thailand, which may tax foreign earnings. It makes financial planning much simpler.

It is crucial to consult a tax professional who understands international law. The rules in your home country still apply. For example, US citizens must file returns on worldwide income.

Cost Comparison and Savings Insights

The combination of tax exemption and a low cost of living creates a powerful value proposition. Your money goes significantly further.

While income tax is exempt, you will pay a 12% Value Added Tax (VAT) on local purchases. This is relatively low and built into prices.

The table below highlights the key financial differences for a remote worker over two years.

| Financial Aspect | Typical High-Cost Country | Philippines with DNV |

|---|---|---|

| Local Income Tax on Foreign Earnings | Often Applicable | Exempted |

| Average Monthly Living Cost | $2,500 – $4,000+ | $1,000 – $1,800 |

| Financial Planning Complexity | High (Double Taxation Risks) | Lower (Clear Exemption) |

This favorable financial environment allows you to maximize savings while enjoying a high quality of life. It’s a win-win for your career and wallet.

Application Process and Timeline

The journey to securing your visa begins with a clear and organized application process. Knowing what to expect can make everything smoother.

Start by gathering all required documents. You will need a valid passport, proof of foreign income, health insurance, and a police clearance. Having these ready is crucial.

Online Application Portal Process

The Philippine Bureau of Immigration will likely use a dedicated online portal. This system allows you to complete forms and upload documents from anywhere.

After the initial online submission, you may need an appointment. This is often at a local embassy to verify your original passport and paperwork.

Payment of the application fee, estimated between $200 and $500, will be part of this step. This fee is required before processing starts.

Expected Processing Times

Official estimates suggest approval in under 30 days. However, it’s wise to plan for a longer time.

Similar visa types, like work permits, can take 2-3 months. Early applicants might face delays as the system launches.

Submitting a complete and accurate application is the best way to avoid extending this timeframe. Double-check all details.

Do not finalize travel plans or end leases until you have official approval. This protects you if processing takes extra months.

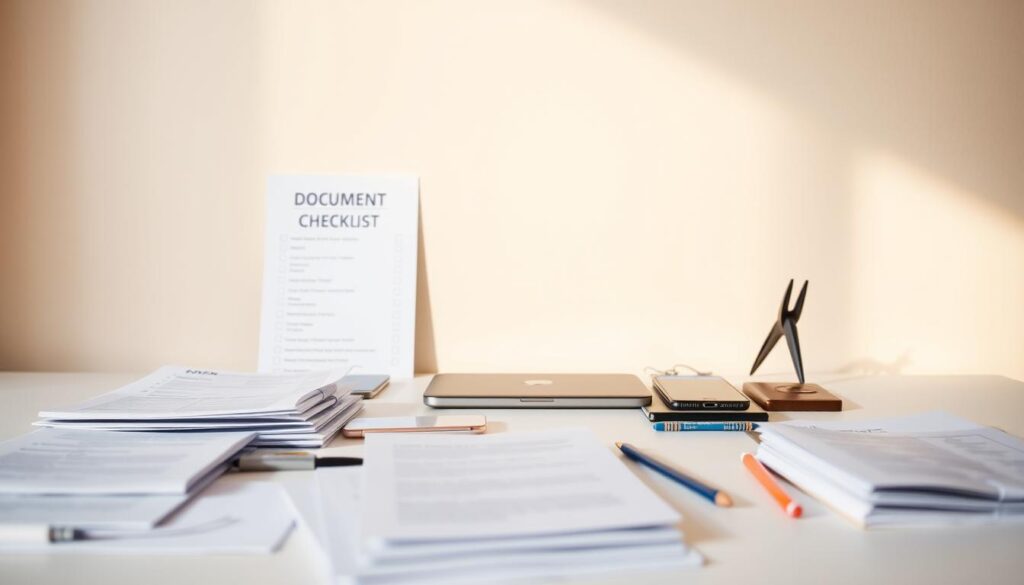

Document Checklist and Preparation Tips

Before you can enjoy island life, you’ll need to assemble a comprehensive set of required documents. Getting organized early prevents last-minute stress.

Your passport must be valid for six months beyond your planned stay. Ensure it has blank pages and shows no damage. These details matter during the visa review.

Income proof is critical. Remote employees need employment contracts and recent bank statements. Freelancers should provide client agreements and payment records.

Starting the document process three months ahead saves time and reduces anxiety.

Health insurance documents must show full coverage for your entire stay. Choose a reputable international provider.

The criminal background record requires special attention. You’ll need a police clearance with Apostille certification. This process can take several weeks.

| Document Type | Key Requirements | Processing Time |

|---|---|---|

| Passport | 6+ months validity, blank pages | Immediate |

| Income Proof | Foreign-source earnings, consistent deposits | 1-2 weeks |

| Police Clearance | Recent certificate with Apostille | 3-4 weeks |

| Health Insurance | Full coverage for visa duration | 1 week |

Create digital backups of all documents. You’ll need them for banking and rental agreements later. Keep everything organized in both physical and cloud storage.

Exploring Digital Nomad Hotspots in the Philippines

Finding your perfect base is a key part of the digital nomad experience. The country’s incredible diversity means there’s a place for every work style and personality.

Major cities offer top-tier infrastructure. Beach towns provide a slower pace of life. You can easily mix and match destinations throughout your stay.

Top Cities and Regions

Each location offers a unique vibe for remote professionals.

- Manila: The capital is the primary hub for digital nomads. It has the fastest internet and most coworking spaces. You’ll find a large community of young people and expats here.

- Cebu: This city is an ideal middle ground. It blends urban life with easy beach access. Many nomads enjoy its historic charm and modern amenities.

- Siargao: This island is a paradise for surfers. It’s the perfect place for those who love a beach lifestyle. A strong international community has developed here.

- Davao: For a more authentic culture, Davao is a great choice. It has fewer tourists and a lower cost of living. The local people are very welcoming.

- Baguio: Escape the heat in this cool mountain city. It attracts creative nomads and has improving internet. It’s perfect if you prefer a cooler climate.

Other amazing spots include the dramatic landscapes of Batanes and the world-class diving in Coron. You can explore history in Vigan or enjoy nightlife in Boracay.

With over 7,000 islands, the options are endless. This makes being a digital nomad in the Philippines an adventure. You can always find a new place to explore.

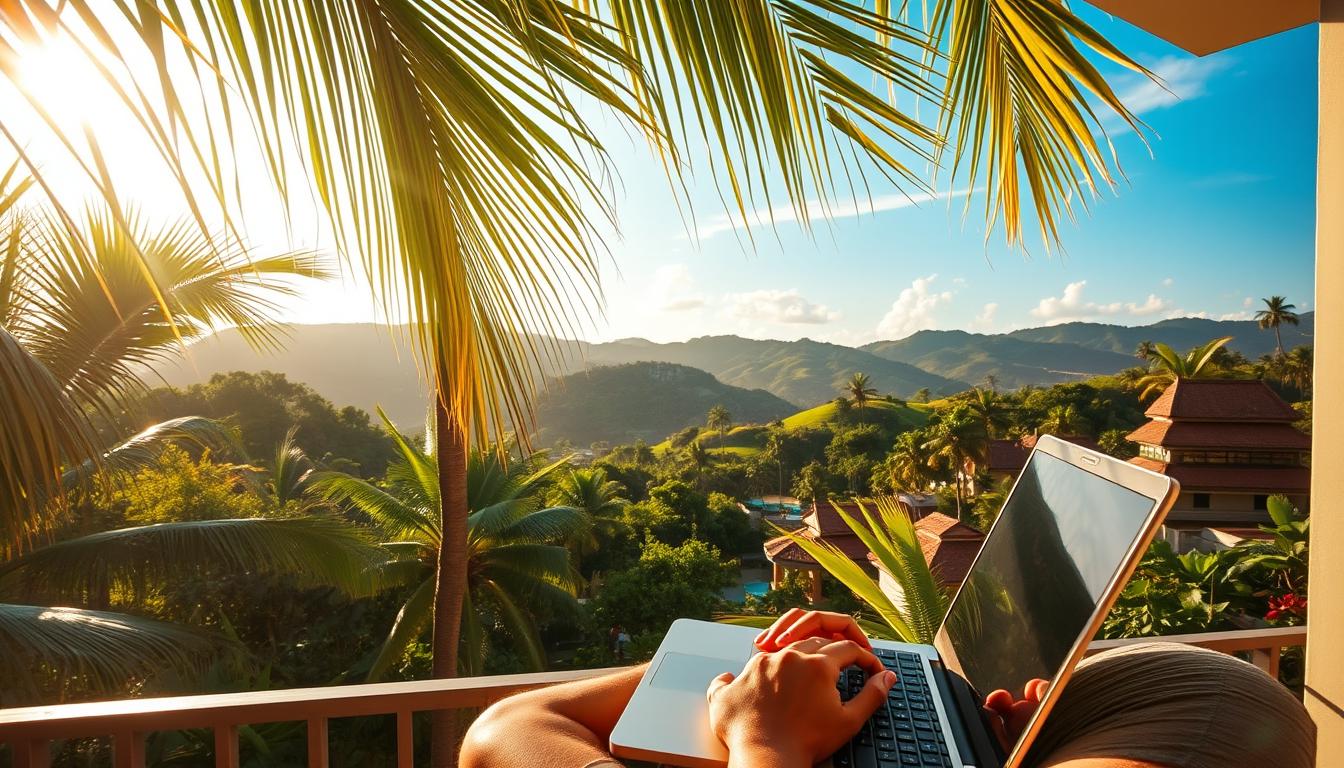

Cost of Living and Accommodation Insights

Your income can stretch significantly further when you understand local pricing structures. This financial advantage makes the archipelago an attractive destination for remote professionals.

Monthly Expenses and Budgeting

Before rent, expect to spend around $500 monthly for comfortable living. This covers meals, utilities, and entertainment.

Food costs are remarkably affordable. A local lunch runs about $3.50. Nice restaurant dinners average $10-15. Groceries for home cooking cost $100-150 monthly.

Utility expenses include $100 for electricity and $40 for reliable internet. Beer costs just $1.50, making social outings budget-friendly.

Accommodation costs vary by city. Manila averages $575 for a one-bedroom. Cebu offers mid-range at $465. Davao provides the best value at $260.

Combining rent and living expenses, a comfortable lifestyle totals $1,200-1,800 monthly. This represents 3-4 times more purchasing power than Western locations.

For remote workers earning $3,000-5,000, this cost of living advantage enables higher savings or better quality of life. Your money goes much further here.

The Role of Remote Work Culture in the Philippines

Beyond the visa benefits lies a supportive environment that makes remote professionals feel truly at home. The local business landscape provides unique advantages that complement the digital nomad lifestyle perfectly.

Local Business Environment

English serves as an official language, making communication seamless for international workers. This eliminates language barriers that exist in many other Asian countries.

Filipino culture is known for exceptional hospitality toward foreigners. Locals are genuinely friendly and helpful, making integration into communities effortless.

The internet infrastructure supports remote work with 90% penetration in urban centers. Speeds continue to improve for video conferencing and large file transfers.

Professional coworking spaces with high-speed internet are expanding rapidly. They provide reliable workspaces and networking opportunities beyond major cities.

The vibrant startup scene offers collaboration potential with local entrepreneurs. Many young professionals build tech companies and creative ventures.

Established expat communities create ready-made social networks for newcomers. This combination of infrastructure and welcoming culture makes the environment ideal for remote work.

| City | Internet Speed | Coworking Spaces | Expat Community |

|---|---|---|---|

| Manila | High | Extensive | Large |

| Cebu | Good | Growing | Established |

| Siargao | Improving | Emerging | Active |

| Baguio | Reliable | Developing | Growing |

For remote workers, having the right tech tools enhances productivity in this supportive environment. The local business culture welcomes international professionals and their clients.

Ensuring Compliance and Avoiding Penalties

Compliance isn’t a one-time event but a continuous responsibility during your stay. Immigration officials are paying closer attention to remote professionals worldwide.

One violation could lead to deportation and future entry bans. The legal protection this program offers justifies any application cost for extended stays.

Staying Updated with Immigration Laws

You must maintain valid health insurance throughout your entire stay. Your income must come exclusively from foreign sources.

Working with local clients violates your visa terms. This could force you to convert to a different work permit.

Stay informed about policy changes by checking the Bureau of Immigration website regularly. The rules may evolve during the first few years.

Maintain strong ties to your home country for tax and legal purposes. Continue filing taxes there and keep banking relationships active.

Start your renewal process 60-90 days before your initial visa expires. This prevents gaps in your legal status.

| Compliance Area | Requirement | Consequence of Violation |

|---|---|---|

| Health Insurance | Full coverage for visa duration | Visa revocation |

| Income Source | 100% foreign clients/employers | Deportation risk |

| Renewal Timing | Apply 2-3 months before expiry | Legal status gap |

| Policy Awareness | Regular immigration updates | Unintentional violations |

Early adopters might face processing delays as the system launches. Waiting 6-12 months for stabilization could be wiser unless you need immediate status.

This approach gives you better options and reduces administrative confusion. Your adventure deserves proper legal foundation.

Conclusion

For location-independent professionals weighing their options in Southeast Asia, the Philippines presents a uniquely balanced opportunity. The new digital nomad visa offers clear advantages for those planning extended stays.

This program provides legal work authorization and tax benefits. It suits mid-level earners seeking affordable tropical living. The initial twelve-month validity with renewal options creates stability.

Short-term visitors might prefer tourist visa extensions. But for commitments over six months, this visa makes perfect sense. The combination of English fluency and welcoming culture appeals particularly to American remote workers.

Start gathering documents like police clearances now. Research cities that match your work style. When ready, you can build a compliant lifestyle across beautiful islands.

The Philippines digital nomad program represents smart planning for sustainable location independence. It delivers exceptional value for your career and adventure goals.